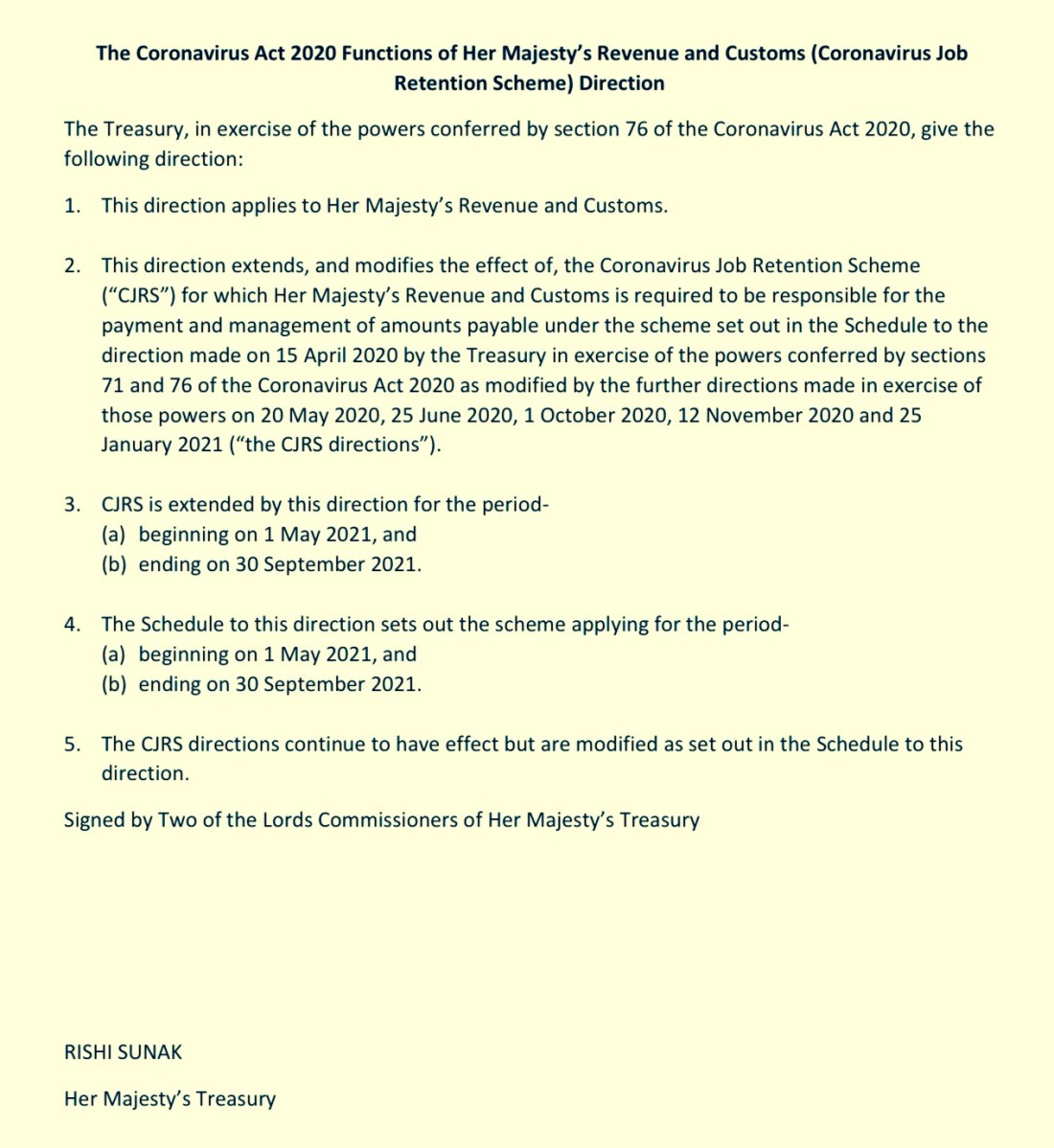

The 7th CJRS Treasury Direction made under Sections 71 and 76 of the Coronavirus Act 20

This direction extends, and modifies the effect of, the Coronavirus Job Retention Scheme (“CJRS”).

The extension applies from 1st May 2021 ending on 30th September 2021.

Reference dates for determining reference salary and usual hours

The reference date is determine by when employment commenced and payments originally reported on the Real Time Information (RTI) Full Pay,net Submission (FPS). The judgement dates basis for the calculation are set as:

- 19th March 2020 – group 1

- 30th October 2020 – group 2

- 2nd March 2021 – group 3

The direction sets out the calculation of reference salary and usual hours for each of the groups.

Claim deadlines

The CJRS deadline days are-

(a) 14th June 2021 in relation to the May 2021

(b) 14th July 2021 in relation to the June 2021

(c) 16th August 2021 in relation to the July 2021

(d) 14th September 2021 in relation to the August 2021

(e) 14th October 2021 in relation to the September 2021

Late claims

It is indicated that HMRC may accept a CJRS claim made after the relevant CJRS deadline day if-

(a) there is a reasonable excuse for the failure to make the claim in time, and

(b) the claim is made within such further time as HMRC may allow.

PAYadvice.UK 15/4/2021